Processes

The QBO Process module tracks business processes from inception to completion. Examples include loan origination, account collections, customer complaint resolution, compliant audit reviews, foreclosures, short sales, bankruptcies and many more use cases.

Processes share common characteristics, including:

- Opened and closed dates and reasons

- Optional outsourcing of the process to a third party (including secure extranet access)

- Automated launching of a workflow in tandem with the creation of a process

- Tracking related receipts and expenditures incurred during the execution of the process

- Analytics to calculate the ROI associated with the process

Why Create Processes?

In the financial services world, it is tempting to create origination, servicing, collection, bankruptcy, and other such workflows to be ‘bound’ to a loan. For simple use cases, this works just fine. Keep in mind, however, that if a workflow is bound to a loan, then:

- Tasks created will be bound to the loan

- Documents created will be bound to the loan

- Child workflows will also be bound to the loan

This gets complicated when you start launching simultaneous workflows, such as a foreclosure alongside a short sale, or a loan modification alongside a collection workflow. Documents created for short sales are mixed with the documents created for a foreclosure. Tasks created to manage the loan modification are intermingled with tasks for the collection. Imaging a manila folder used to store all loan information in: one folder contains all of your documents, checklists, and yellow sticky notes from all of the departments ‘touching’ the loan. In short, it’s easy to confuse your end users.

Creating a process enables binding a workflow to the process, instead of the loan. The fat manila folder representing your loan now has thinner folders (processes) inside of it, one for each foreclosure, short sale, loan modification and collection effort. Each process is self-contained, so a short sale processor can focus on just the tasks and documents that impact him, while a loan modification officer can focus on just the tasks and documents that impact her.

Creating a process enables binding a workflow to the process, instead of the loan. The fat manila folder representing your loan now has thinner folders (processes) inside of it, one for each foreclosure, short sale, loan modification and collection effort. Each process is self-contained, so a short sale processor can focus on just the tasks and documents that impact him, while a loan modification officer can focus on just the tasks and documents that impact her.

As always, managers can review everything from the loan level. The Process Dashboard enables managers to quickly see their active processes, including fetching exactly the ‘bucket’ of processes their interested in viewing.

As always, managers can review everything from the loan level. The Process Dashboard enables managers to quickly see their active processes, including fetching exactly the ‘bucket’ of processes their interested in viewing.

Process Templates

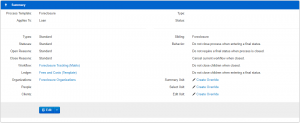

Power users can define process templates that drive powerful behaviors, including:

Power users can define process templates that drive powerful behaviors, including:

- Define a workflow to be launched when a process is created

- Define a ledger to be created to track the costs associated with the process

- Define a group of vendors eligible to work (be assigned to) the process

- Define a group of users eligible to work on the process

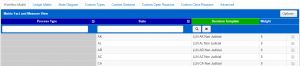

Rules that may seem simple at first can quickly grow complicated, and process templates help manage this complexity. For example, assume you wish to launch a foreclosure workflow whenever a foreclosure process is created. If you have state-specific foreclosure workflows, the process template can be used to leverage a matrix to decide which workflow to launch (based on state and any other data points you choose).

Rules that may seem simple at first can quickly grow complicated, and process templates help manage this complexity. For example, assume you wish to launch a foreclosure workflow whenever a foreclosure process is created. If you have state-specific foreclosure workflows, the process template can be used to leverage a matrix to decide which workflow to launch (based on state and any other data points you choose).